Strategy

Table 2 below describes the climate-related risks and opportunities that could reasonably be expected to affect Essential Energy’s prospects. They focus on Essential Energy’s regulated electricity business, with some effects for Essential Water and Intium incorporated. More detailed analysis for Essential Water and Intium is planned for 2025–26.

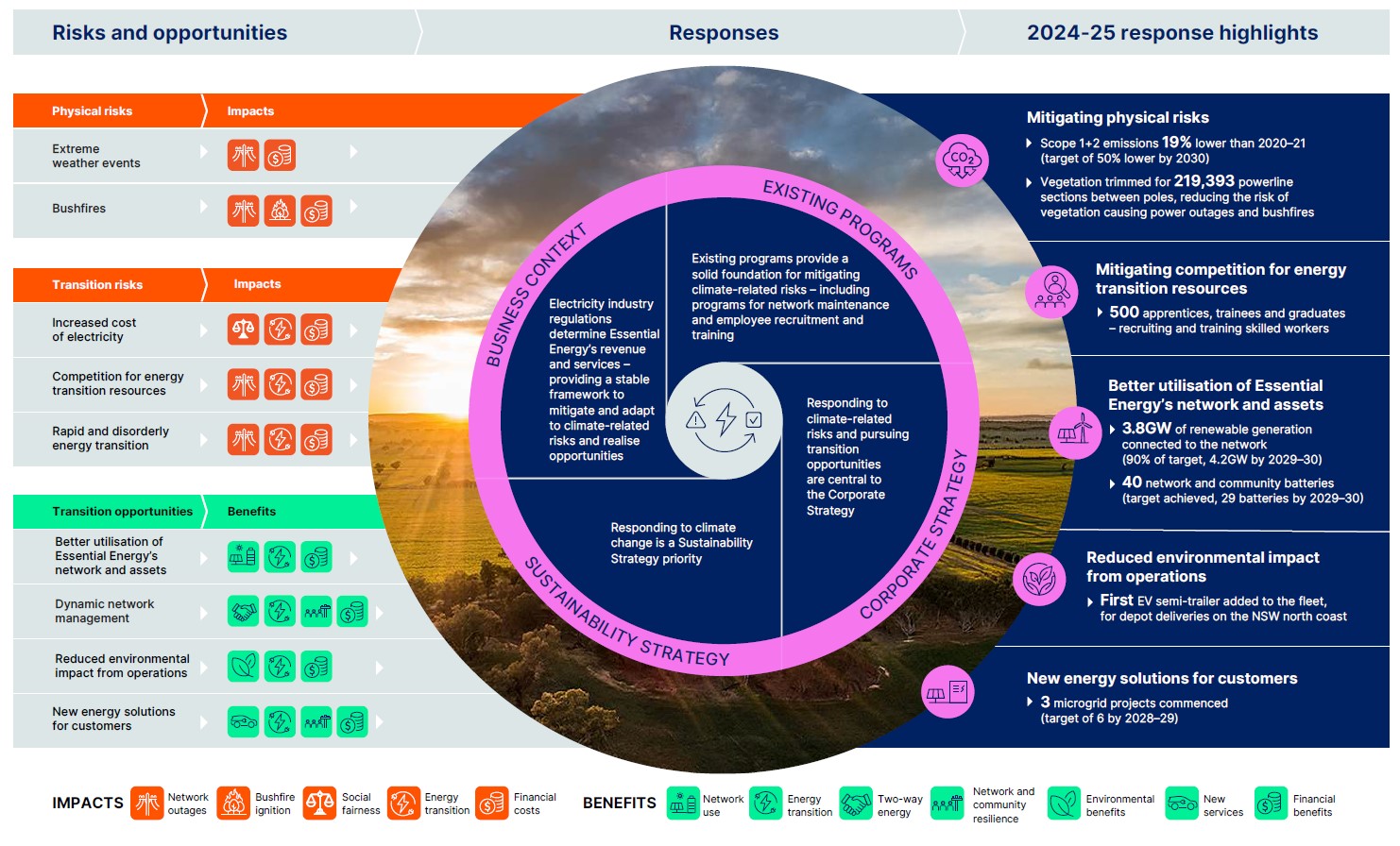

Responding to climate-related risks and opportunities

Time horizons

Essential Energy defines short term as zero to five years, medium term as five to 10 years, and long term as beyond 10 years. This aligns with the five-yearly funding cycle for electricity regulatory determinations and water pricing determinations. Network infrastructure investment decisions are long term, as infrastructure assets have multi‑decade lifespans.

Physical risks

Effects from extreme weather events, including bushfires, have always been a material risk for Essential Energy. These are likely to increase over the short, medium and long term, as climate change progresses. The effects will increase even under low emissions scenarios, with more severe increases under high emissions scenarios.

Transition risks

Effects from the three transition risks are already being felt across the energy industry, with energy transition costs impacting customers’ bills and competition for resources increasing construction costs. The speed of the transition is also raising network reliability challenges, such as the increasing need to balance two-way energy flows from consumer energy resources (particularly rooftop solar). These impacts are likely to increase over the short, medium and long term as the energy transition progresses; and be more pronounced under lower emissions scenarios, which require a more rapid transition.

Transition opportunities

The four transition opportunities are all in the early stages of realisation. In some cases, trials are being undertaken. In other cases, business-as-usual activities are shifting. Benefits are likely to increase over the short, medium and long terms as the transition progresses. Transition impacts will be greater and faster under low emissions scenarios. However, within these scenarios the risk of failing to capture the full benefit of opportunities will also be greater, if Essential Energy is not able to adapt quickly to a rapid and disorderly transition.

Business model

As an electricity distribution network service provider, Essential Energy can access and has accessed multiple funding pathways to absorb and respond to climate-related risks and opportunities without jeopardising the business model.

Pathways include:

- The five-yearly regulatory determination process, which sets revenue that can be earned, based on capital and operational spending allowances, including to manage network resilience initiatives and to enable consumer energy resources. This is the primary funding pathway. The current five-year period includes $205 million for climate-related network resilience initiatives (see ‘Case study: Mitigating physical risks‘).

- Cost pass through mechanisms, for unexpected costs associated with certain defined categories, such as those involved in responding to extreme weather events.

- Contingent projects, which provide for cost recovery if certain conditions are met. These are for capital projects which may be required during the course of a regulatory determination period, but not certain at the time the regulatory determination was made.

- Cost recovery from renewable energy generation and storage proponents for new infrastructure to connect large-scale renewable generation and storage facilities to the network.

- Funding under the Electricity Infrastructure Investment Act 2020 (NSW) (EII Act) for major and identified priority network infrastructure projects.

- Government grants for initiatives that respond to climate-related risks and opportunities.

These funding pathways are subject to approval by the AER. For the first three pathways, revenue is collected from all customers connected to Essential Energy’s distribution network via network charges, as a component of customers’ electricity bills. Revenue for major or identified priority infrastructure projects funded under the EII Act is collected from all NSW electricity customers (regional and metropolitan) connected to the three distribution networks. AER regulation provides Essential Energy with a solid framework to mitigate and adapt to climate-related risks and realise opportunities.

As a State Owned Corporation, Essential Energy’s business model also extends beyond finances, creating value for society through:

- Safe and reliable electricity supply to residential and commercial customers and community services, along with safe and reliable water and sewerage services for Far West NSW

- Careers for people across the regional, rural and remote network area

- Supporting regional communities to benefit from the energy transition

- Helping the network and communities to be resilient in response to climate change and the energy transition.

Impacts on the business model

Physical risks

The two physical risks (R1, R2) affect the business model by requiring increased operational expenditure (both preventative and recovery costs), while also requiring increased investment in additional protection and solutions for network and community resilience. These operating and investment costs are recovered from our customers as increased revenue (pending AER approval) or are funded through government grants. These physical risks also create more challenging conditions for providing safe and reliable electricity, as well as providing reliable water and sewerage services (the latter two for Essential Water in Far West NSW).

Our physical risks apply to the entire physical network, as severe weather events and bushfires can and do occur across all parts of the network area. However, Climate Impact Assessment (CIA) modelling for bushfires, floods and windstorms, under future climate change scenarios, shows the likelihood and severity of these risks will vary across the network area. This modelling is being used to prioritise mitigation activities. See ‘Case study: Mitigating physical risks‘.

Transition risks

Skills and materials shortages (R4) may affect the business model by increasing operating and investment costs. Where efficient, these additional costs can be approved for recovery by the AER, but in doing so they affect the cost of providing electricity distribution services (R3), and through higher prices could impact our customers and potentially jeopardise revenue over longer timeframes.

Both the cost of electricity (R3) and skills and materials shortages (R4) may be further exacerbated in conditions where the energy transition is rapid and disorderly (R5), or where Essential Energy’s role is constrained by the economic regulatory framework. This may raise operating and investment costs, and could limit Essential Energy’s role in enabling the energy transition.

The transition risks impact Essential Energy’s sources of non-financial value, including providing regional careers (R4) and helping communities remain resilient to climate change, while also providing safe and reliable electricity and regional benefits from the energy transition (R3 to R5).

These risks apply to all customers and across the entire distribution network area. However, they may be felt more keenly by financially vulnerable customers and by those not able to benefit directly from energy transition opportunities (such as rooftop solar and home batteries). Geographically, competition for skilled electricity workers may be greater in more remote parts of the network area, due to challenges attracting people to live and work in these areas.

Transition opportunities

The four transition opportunities have the potential to increase the value of Essential Energy’s network and associated assets, retain and bring online additional sources of revenue, lower overall energy transition investment costs (than they would otherwise be) and reduce emissions. They can also play a mitigating role for the climate-related risks.

There are also non-financial benefits, as all four opportunities have the potential to boost network and community resilience to climate impacts, while providing opportunities for regional communities to benefit from the energy transition.

The transition opportunities apply in principle across the whole network. However, some element of concentration is present. For example, some parts of the network have greater capacity for increased use. Also, some parts of the network will benefit more from alternative solutions such as microgrids and SAPS, particularly remote areas.

Strategy and decision making

Essential Energy’s responses to identified climate-related risks and opportunities (table 2) are led by, and integrated into, the Corporate Strategy, Sustainability Strategy and business-as-usual programs.

Physical risks

Physical climate-related risks are primarily operational and are already present, which means Essential Energy has significant experience adapting to and mitigating these risks. During 2024–25 our crews responded to numerous severe weather events. Operational adaptation and mitigation responses include:

- Network maintenance – policies, processes and systems for network planning, asset inspection and maintenance, vegetation management, bushfire preparations, and fault and emergency response

- Worker safety – support to ensure employees are fit to deploy during extreme weather events, and recover well from these deployments, including processes and information for fatigue management, hydration, nutrition and proactive management of mental health through the Employee Assistance Program; as well as deploying solutions for internet access in remote areas

- Public safety – annual public safety activities seek to raise awareness for electricity hazards, as well as awareness of how to minimise public safety risks, including during storms and floods.

Strategic adaptions and mitigations include: deploying SAPS and microgrids for customers and communities in remote locations; developing a digital twin of the physical network, to inform targeted and risk-based decision making; and trialling automated approaches for early detection of network faults.

Transition risks and opportunities

Responses to transition risks and opportunities are addressed holistically by the Corporate Strategy, which sets a clear direction for how Essential Energy can create greater value for the business, customers and stakeholders from the energy transition, while also mitigating energy transition risks. Corporate Strategy progress during 2024–25 is summarised on the Strategy pages and relevant climate-related metrics and targets are included in tables A14 and A15 (see tables A14 and A15 in ‘Appendices’, Annual Report 2024-25 PDF, page 143 to 144).

Business-as-usual programs also mitigate competition for energy transition resources (R4), including:

- Competition for skilled workers:

- Early Talent Pathways Program for apprentices, trainees and graduates – recruiting, training and creating careers for people in regional locations

- Future skills training programs for existing employees

- Employee benefits scheme – to help attract and retain workers.

- Competition for materials and equipment:

- Procurement initiatives to strengthen local supply chains through long-term partnerships, diversifying suppliers, improving and increasing inventory holdings, and monitoring market and economic conditions.

Transition planning

Development of a transition plan, focused on the regulated Essential Energy business, commenced during 2024–25, and will continue during 2025–26. Many elements are already well developed, including a Scope 1 and 2 emissions reduction target, risk and opportunity responses, and strategic clarity on Essential Energy’s role in the energy transition.

Resourcing

For the regulated electricity distribution network business, current and anticipated responses to all nine climate-related risks and opportunities are, and will continue to be, resourced via Corporate Strategy initiatives, Sustainability Strategy initiatives, and business-as-usual programs. These are primarily funded by regulated revenue from the provision of distribution services, plus funding from renewable energy generation proponents for connections infrastructure, and some funding from government grants. Future resourcing is expected to come from these same sources, and may also include EII Act funding for major infrastructure projects.

Worker resourcing is existing employees, with annual recruitment programs for apprentices, trainees and graduates, as well as future energy skills training for existing employees. Contractors may also be used as required.

Unregulated market opportunities are resourced through Intium, with funding from commercial revenue for projects. Worker resourcing is Intium employees, with shared services support from Essential Energy, and contractors as required.

Financial position, performance and cash flows

The financial impacts of climate-related risks and opportunities during 2024–25 have not been quantified. For this to occur, baseline financial information needs to be set for each risk and opportunity, and then increases or decreases due to climate change tracked within financial reporting. For example, extreme weather events have always been a physical risk for Essential Energy, so baseline impacts need to be determined before changes due to climate change can be tracked. This baselining work will commence during 2025–26 as part of plans to improve the integration of climate-related risks and opportunities into existing business processes.

Currently, there is no expected risk of material adjustment to the carrying amounts of assets and liabilities in the 2025–26 financial year. Every three years a fair value assessment of Essential Energy’s distribution network assets to ensure net carrying value remains materially consistent with fair value is undertaken by external experts for Essential Energy. A valuation was undertaken during 2024–25, confirming the carrying value of assets remains consistent with fair value.

In assessing the potential financial impacts of climate-related risks and opportunities, key judgements and estimates will consider the impact of climate change on the range of economic conditions forecast over the remaining useful lives of assets, including expectations about future operations, the outlook for commodity prices, discount rates, capital expenditure requirements and market supply and demand profiles. This is dependent on climate-related scenario analysis, which is yet to be undertaken.

From a financial perspective, the items and considerations that could be impacted by climate-related risks and opportunities in the medium to long term include:

- Useful lives of property, plant and equipment – possible increased maintenance and capital spend due to shorter useful lives. When reviewing the expected useful lives of assets, climate-related matters are considered, such as restriction on use of assets or assets requiring significant capital or maintenance works.

- Fair value and impairment of non-financial assets – possible increased expenditure to adhere to more stringent or new climate-related requirements as well as increased revenue due to forecast opportunities are included in the cash flow forecasts used to access fair values and impairments of assets.

In the short term, climate-related risks and opportunities are not anticipated to have a significant impact on Essential Energy’s overall financial position and performance. This assessment is based, firstly, on the fact that strategic direction and activities, set in the Corporate Strategy, Sustainability Strategy and business-as-usual programs, are strongly consistent with responding to climate-related risks and opportunities. In addition, as a regulated business, Essential Energy has the ability to seek recovery from the AER through multiple pathways for costs associated with climate-related risk and opportunity responses. Finally, as a crucial enabler of the energy transition, Essential Energy can receive government grants to pursue climate resilience and transition initiatives.

Over the medium to longer term, the financial effects of climate-related risks and opportunities are harder to assess. The impact of climate-related risks and opportunities will depend on any changes to the regulatory framework under which Essential Energy operates, the magnitude and frequency of climate-related events, future infrastructure investment, technological advancement, change in legislation and public expectation. Essential Energy is closely monitoring relevant changes and developments across these areas.